About a month ago, Google introduced what now seems like a very obvious change to its results pages: it removed paid search ads from the right-hand side.

Apparently Google made this change based on years of testing. These tests showed that no one was really clicking on these ads and it would better align with the mobile experience if they simply weren't there.

The impact of this means there will be less inventory, and ranking at the top of the page is potentially even more important than ever before.

So now that we are a few weeks into this change what is the impact? Did everything the industry predicted come true?

To understand the impact I ran a keyword level report that included the Top vs. Other segment, looking at three weeks post and prior to the change.

There are three things to note:

1) Inventory is down

As expected, with no more ads on the right-hand rail there are less ad spots available. As a result we are seeing a 19% decrease in total inventory. The majority of that reduction is within the Other bucket.

2) Traffic shifts

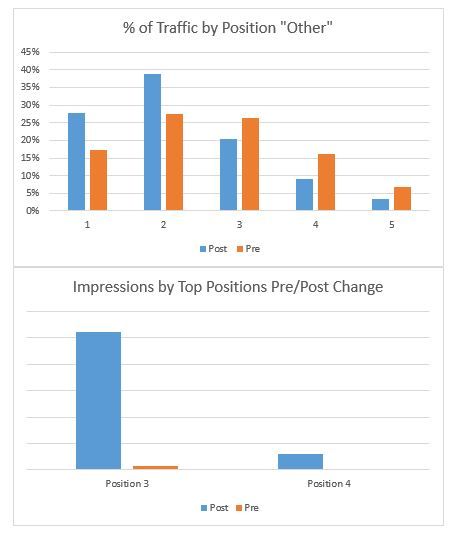

You can see from the data below that traffic for positions below the organic listings has shifted up significantly and dropped in lower positions due to inventory restrictions. You also see an increase in traffic to positions 3 & 4 in the Top ads. While the increase is still noticeable, it is still <5% of total traffic in the post-right-hand-side-ad world. This implies that either we don't manage a lot of brands that have 'highly commercial' queries or that the impact of adding a 4th position is still pretty small.

3) Despite these changes CTRs and CPCs are down

The fact that click-through rates are up isn't that big of a surprise given the fact that more ads are seen by searchers, so you would expect more click-throughs to occur. What is really good news for advertisers is the fact that consumers are responding well to the new layout of the page: CTR is up {12%) and CPCs are down (-11%). Hopefully this will help overcome the reduction in overall inventory.

So what does it all mean?

This is a big change that seems to be having the expected impact of reducing total inventory, but increasing the amount of traffic as a percent of total impressions.

Advertisers need to be taking a look at their own data. Are they seeing different data? Are CPCs going up in certain areas given competition? Is the incremental CPC worth it to your business, or does the reduction in CPC allow you to spend more in other areas?

Staying close to your Top vs Other data segments and detailed data points will allow you to respond to this change in a smart and sophisticated way.

No comments:

Post a Comment